目录

装修后再融资的利与弊

对于希望利用房产增值的房主来说,装修后的再融资是一个常见的考虑因素。虽然装修后再融资肯定有好处,但也有一些潜在的缺点需要考虑。在本文中,我们将探讨装修后再融资的利弊,以帮助您做出明智的决定。

装修后再融资的主要好处之一是有可能降低您的每月抵押贷款付款。通过以较低的利率再融资,您可以减少每月还款额并在贷款期限内节省资金。如果您已经申请了房屋净值贷款或信用额度来为装修融资,这可能特别有利,因为再融资可以帮助您巩固债务,并可能降低每月的总付款额。

装修后再融资的另一个优点是获得您房屋净值的机会。如果您的装修增加了您的房产价值,您可以通过现金再融资以该资产为抵押进行借款。这可以为您提供额外的房屋改善、债务合并或其他财务目标所需的资金。

另一方面,装修后再融资存在一些潜在的缺点。主要缺点之一是与再融资相关的成本。再融资可能涉及成交成本、评估费和其他快速增加的费用。在决定再融资之前,重要的是要仔细考虑潜在的节省是否超过再融资的成本。

装修后再融资的另一个潜在缺点是对您的信用评分的影响。当您申请新的抵押贷款时,贷方将提取您的信用报告,这可能会暂时降低您的信用评分。如果您计划在不久的将来进行再融资,请务必避免承担任何新债务或做出任何可能对您的信用评分产生负面影响的重大财务决策。

总而言之,装修后再融资有利有弊。在做出决定之前,请务必根据您的具体情况仔细权衡再融资的潜在好处和缺点。如果您正在考虑装修后再融资,咨询财务顾问或抵押贷款专业人士可能会有所帮助,讨论您的选择并确定适合您个人需求的最佳行动方案。最终,装修后再融资的决定应基于您的财务目标、当前利率和整体财务状况。

如何确定装修后再融资是否适合您

对于希望降低每月抵押贷款付款或获得房屋净值的房主来说,装修后再融资可能是一项明智的财务举措。但是,在决定是否再融资之前,请务必仔细考虑您的个人情况。在本文中,我们将讨论如何确定装修后再融资是否适合您。

装修后决定是否再融资时首先要考虑的事情之一是当前利率。如果自您最初提取抵押贷款以来利率已经下降,那么再融资可能会为您节省每月还款额。通过确保较低的利率,您也许能够减少每月的抵押贷款付款,并在贷款期限内节省数千美元。

另一个需要考虑的因素是您的房屋净值金额。如果您的房屋因装修而增值,您可以通过现金再融资获得该资产。如果您需要资金用于另一个家居装修项目、偿还高息债务或满足其他财务需求,这可能是一个不错的选择。请记住,现金再融资通常会带来更高的结账成本,并且可能会延长您的贷款期限,因此在继续之前权衡利弊非常重要。

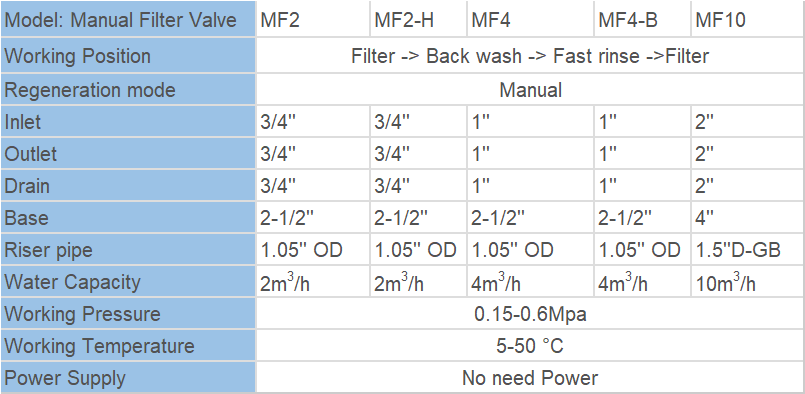

| 类别 | 类型 | 特点 | 型号 | 入口/出口 | 排水 | 基地 | 立管 | 盐水管线连接器 | 水容量m3/h |

| 自动软水阀 | Downflow & Upflow Type | Supply Hard Water during Regeneration | ASB2 | 1/2″, 3/4″, 1″ | 1/2″ | 2.5″ | 1.05″ OD | 3/8″ | 2 |

| ASB4 | 1/2″, 3/4″, 1″ | 1/2″ | 2.5″ | 1.05″ OD | 3/8″ | 4 |

It’s also important to consider your long-term financial goals when deciding whether to refinance after a renovation. If you plan to stay in your home for the foreseeable future, refinancing could be a good way to save money on your mortgage and potentially access additional funds. However, if you plan to sell your home in the near future, it may not make sense to refinance, as the costs associated with refinancing may outweigh the potential savings.

Before making a decision about refinancing after a renovation, it’s important to carefully review your current mortgage terms and compare them to any potential new loan offers. Consider factors such as interest rates, closing costs, and the length of the loan term. You may also want to consult with a financial advisor or mortgage professional to help you determine the best course of action based on your individual financial situation.

In conclusion, refinancing after a renovation can be a beneficial financial move for some homeowners, but it’s important to carefully consider your individual circumstances before making a decision. By evaluating factors such as interest rates, equity in your home, and your long-term financial goals, you can determine whether refinancing is right for you. Remember to weigh the pros and cons, compare loan offers, and seek advice from a professional before moving forward with a refinance.